Buy Recommendation on BBIO

On October 27, 2025, AI Stock Tickers issued a buy signal for BridgeBio Pharma (BBIO)

AI Stock Tickers' Buy Recommendation on BBIO: A Retrospective Look

In the fast-paced world of stock trading, timely recommendations can make all the difference. On October 27, 2025, AI Stock Tickers issued a buy signal for BridgeBio Pharma (BBIO) at a closing price of $63.56, anticipating gains over a 2-4 week horizon. Now, nearly two months later, let's review how this pick performed and compare it to broader market trends.

The Recommendation

AI Stock Tickers specializes in AI-driven insights to identify promising short-term opportunities. The buy call on BBIO was based on factors like positive momentum in biotech sectors, upcoming clinical trial updates, and technical indicators signaling an upward trend. Investors were advised to hold for 2-4 weeks to capture potential gains, with the stock closing at $63.56 on the day of the recommendation.

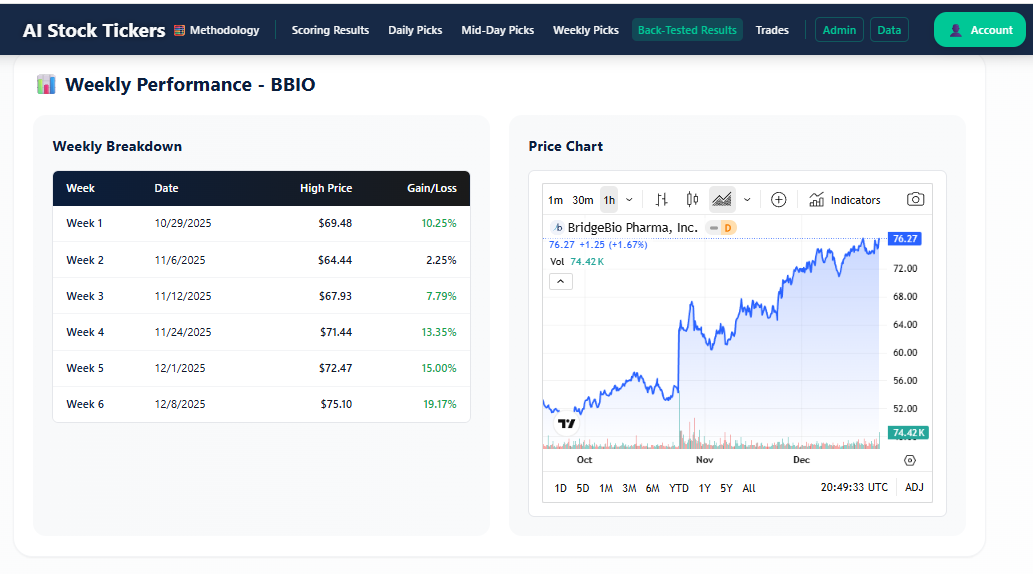

Performance Overview

BBIO experienced some initial volatility but ultimately delivered on the upside within the projected timeframe. Here's a breakdown:

- 2 Weeks Post-Recommendation (November 10, 2025): The stock closed at $62.81, representing a slight dip of about -1.2%. This short-term pullback was not uncommon in the biotech space amid broader market corrections.

- 4 Weeks Post-Recommendation (November 24, 2025): BBIO rallied to $70.99, marking an 11.7% gain from the entry point. This aligned well with the recommendation's outlook.

- Latest Price (December 19, 2025): As of the most recent close, BBIO stands at $76.30, up 20.0% from the October 27 price. The stock has continued its upward trajectory, outperforming initial expectations.

Comparison to the Market

To put BBIO's performance in context, let's compare it to the S&P 500 (tracked via SPY ETF). The broader market faced headwinds during this period, including economic uncertainties and sector rotations. Below is a table highlighting key milestones:

| Date | BBIO Close | BBIO % Change (from Oct 27) | SPY Close | SPY % Change (from Oct 27) |

|---|---|---|---|---|

| Oct 27, 2025 | $63.56 | 0.0% | $685.24 | 0.0% |

| Nov 10, 2025 | $62.81 | -1.2% | $681.44 | -0.6% |

| Nov 24, 2025 | $70.99 | 11.7% | $668.73 | -2.4% |

| Dec 19, 2025 | $76.30 | 20.0% | $680.59 | -0.7% |

As the table shows, while the S&P 500 trended slightly downward over the period, BBIO bucked the trend with significant gains. This highlights the value of targeted AI recommendations in identifying outperformers even in a challenging market environment.

Key Takeaways

- Short-Term Success: The 2-4 week window saw BBIO deliver a solid 11.7% return by week 4, validating the buy signal despite early fluctuations.

- Longer-Term Momentum: The stock's continued rise to $76.30 suggests sustained investor confidence, possibly driven by positive developments in BridgeBio's pipeline.

- AI Edge: Picks like this demonstrate how AI Stock Tickers leverages data analytics to spot opportunities that might elude traditional analysis.

If you're interested in more AI-powered stock insights, head over to AI Stock Tickers for the latest recommendations. Remember, past performance isn't indicative of future results—always do your own research and consider your risk tolerance.

Disclaimer: This post is for informational purposes only and not financial advice.

About AI Stock Tickers

AI Stock Tickers is a financial technology expert specializing in AI-driven market analysis and algorithmic trading strategies. With years of experience in quantitative finance, they provide insights into the intersection of artificial intelligence and financial markets.