Market Sentiment": How NLP Predicts Price Moves

A tech-focused post explaining the "Sentiment Data" pillar. explain simply how Natural Language Processing (NLP) scans news

Decoding "Market Sentiment": How NLP Predicts Price Moves

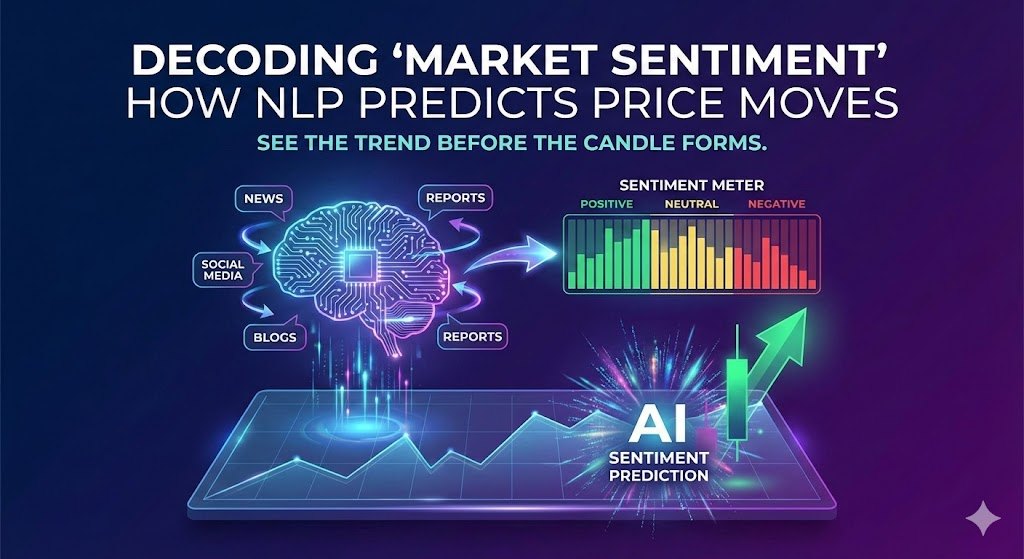

In the ever-shifting landscape of stock markets, where prices can skyrocket or plummet in minutes, understanding the crowd's mood can be as crucial as crunching numbers. Enter "market sentiment"—the collective attitude of investors toward a stock, sector, or the broader economy. But how do you quantify something as intangible as sentiment? This is where Natural Language Processing (NLP), a branch of AI, steps in. In this tech-focused post, we'll demystify the "Sentiment Data" pillar from AI Stock Tickers' 10 Pillars methodology, explaining simply how NLP scans vast troves of news and social media to forecast price breakouts before they even appear on traditional charts.

What is Market Sentiment, and Why Does It Matter?

Market sentiment refers to the overall tone—positive, negative, or neutral—expressed by investors, analysts, and the public about financial assets. It's like the market's emotional pulse: bullish sentiment drives buying frenzies, while bearish vibes trigger sell-offs. Behavioral finance tells us that sentiment often leads fundamentals; for instance, hype around a new product launch can inflate a stock's price well before revenue figures confirm its success.

Historically, traders gauged sentiment through anecdotal clues, like water-cooler talk or analyst reports. But in today's digital age, sentiment is everywhere—buried in tweets, Reddit threads, news headlines, and earnings calls. The challenge? Humans can't process this firehose of data fast enough. That's why AI Stock Tickers leverages NLP to turn unstructured text into actionable insights, predicting short-term (2-4 week) price moves with a precision that outpaces chart-based technical analysis alone.

NLP 101: The Tech Behind Sentiment Analysis

Natural Language Processing is an AI technology that enables computers to understand, interpret, and generate human language. Think of it as teaching machines to "read" like humans, but at superhuman speeds and scales. Here's a simple breakdown of how NLP works in the context of market sentiment:

- Data Collection: NLP starts by gathering raw text from diverse sources. For AI Stock Tickers, this includes:

- News Outlets: Headlines and articles from sources like Bloomberg, Reuters, or CNBC.

- Social Media: Posts from platforms like Twitter (X), Reddit (e.g., r/WallStreetBets), StockTwits, and forums.

- Other Metrics: Broader indicators like Put/Call ratios (options trading sentiment) or the VIX (the "fear index").

- Text Preprocessing: Raw data is messy—full of slang, emojis, typos, and noise. NLP cleans it up by:

- Tokenizing: Breaking text into words or phrases (e.g., "Tesla stock surges" becomes ["Tesla", "stock", "surges"]).

- Removing noise: Stripping out stop words (like "the" or "and") and normalizing (e.g., converting "surges" to its root "surge").

- Handling context: Using techniques like stemming or lemmatization to understand variations (e.g., "buying" and "bought" both relate to positive action).

- Sentiment Scoring: The core magic happens here. NLP models assign scores based on tone:

- Rule-Based Methods: Simple dictionaries flag positive words (e.g., "breakout," "rally") vs. negative ones (e.g., "crash," "scandal").

- Machine Learning Models: Advanced algorithms, like those based on BERT or GPT variants, analyze context. For example, "Tesla is killing it" is positive slang, while "Tesla is getting killed" is negative—NLP catches the nuance.

- Polarity and Intensity: Outputs range from -1 (very negative) to +1 (very positive), with volume factored in (e.g., a spike in mentions amplifies the signal).

- Pattern Detection: Beyond scoring, NLP identifies trends, such as shifting sentiment over time or correlations with events (e.g., a CEO tweet sparking buzz).

In AI Stock Tickers' system, this pillar integrates with others—like technicals or fundamentals—to validate signals. A surge in positive sentiment might predict a breakout, even if charts show consolidation.

Predicting Breakouts: NLP's Edge Over Charts

Traditional technical analysis waits for price action to confirm trends—think waiting for a stock to cross a moving average. But sentiment often leads the charge, creating self-fulfilling prophecies. Here's how NLP spots breakouts early:

- Pre-Chart Signals: NLP detects "behavioral momentum" before volume or price reacts. For example, during the 2021 meme stock boom, NLP could have flagged exploding positive sentiment on Reddit about GameStop days before the chart exploded upward.

- Real-Time Scanning: AI Stock Tickers' engine processes millions of data points daily via APIs, spotting shifts like a viral tweet praising a company's earnings or forum discussions on potential mergers. This "invisible" data layer uncovers opportunities that technicals miss, such as sentiment overrides during earnings seasons.

- Case in Point: Imagine a biotech stock with flat charts but rising positive chatter about FDA approval rumors on social media. NLP quantifies this as a +0.7 sentiment score with high volume, signaling a likely breakout. Integrated with risk metrics, the platform recommends buys with stop-losses for protection.

Studies, like those from MIT's Sloan School, show sentiment-based models can improve prediction accuracy by 10-20% over technicals alone, especially in volatile markets.

AI Stock Tickers: Putting NLP to Work

Within the 10 Pillars, Sentiment Data acts as the "early warning system." The platform's AI Quant engine refines NLP outputs, cross-referencing with macros (e.g., interest rate news) or insider activity for robust picks. This tech-forward approach empowers short-term traders to act on sentiment-driven edges, reducing reliance on lagging indicators.

Of course, NLP isn't infallible—sarcasm or fake news can skew results, which is why multi-pillar integration adds checks. But in a world where information spreads virally, harnessing NLP gives traders a predictive superpower.

Curious to see sentiment in action? Check out AI Stock Tickers' methodology page for more on how this pillar fits into the bigger picture. In trading, timing is everything—let NLP help you stay ahead of the curve.

About AI Stock Tickers

AI Stock Tickers is a financial technology expert specializing in AI-driven market analysis and algorithmic trading strategies. With years of experience in quantitative finance, they provide insights into the intersection of artificial intelligence and financial markets.